About myChoice

Getting Around

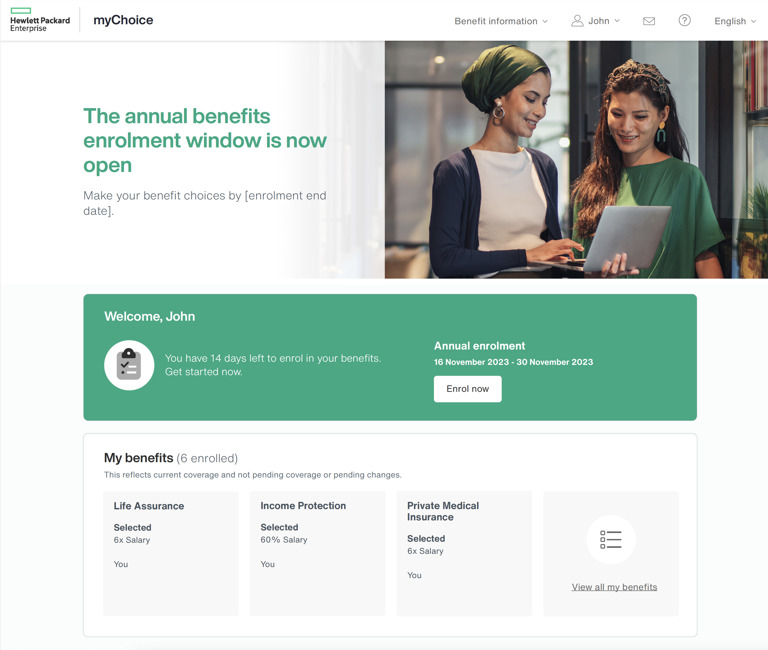

From the myChoice homepage you can:

- Access information on the benefits available to you, including detailed benefit and policy information. View and amend your personal and dependant details.

- Change and manage your benefits.

- Access resources such as myChoice user guides, videos and FAQs.

- Access discounts and offers.

- View information on what we offer on wellness at HPE.

How is my Total Pay made up?

Your Total Pay is made up of two parts:

Flex Fund values reflect the cost of your core contractual benefits, excluding annual leave and company pension contributions*. Flex Fund values will increase/decrease if you experience a change to salary, have a change in working hours, or when there is a change in vendor premiums for your core contractual benefits. Your salary effective 31 October of the previous year is used as the basis for some of these calculations. *Team members on standard employment T&C's.

Flex Fund values reflect the cost of your core contractual benefits, excluding annual leave and company pension contributions*. Flex Fund values will increase/decrease if you experience a change to salary, have a change in working hours, or when there is a change in vendor premiums for your core contractual benefits. Your salary effective 31 October of the previous year is used as the basis for some of these calculations. *Team members on standard employment T&C's.

New to the Company?

If you’ve just joined the Company and do not enrol before the notified deadline date, you will automatically be enrolled in the Core Benefits (click below) for the remaining part of the myChoice year. Should you experience a Qualifying Life Event (QLE) such as marriage or the birth of a child at any time, you can request a new enrolment window where you can make changes to your selections. Refer to "What happens when life changes?" below for more information on QLEs.

What happens when life changes?

We understand that your personal circumstances can change, and this may mean you want to amend your myChoice benefits.

Events which cause big changes in your personal situation are called ‘Qualifying Life Events’ (QLEs). A QLE allows you to make a request to change your benefits package.

If you ever need to make changes to your benefits, go to the module at the top of the page where it says ‘Would you like to make a change?’ and click the ‘Update benefits’ button. You can also update individual benefits in the ‘My benefits’ section. Please remember that changes can only be triggered for qualifying lifestyle events and that some benefits (such as buying or selling Holidays) cannot be changed during the plan year.

Choosing your benefits 101

Your checklist for selecting your benefits:

- Plan ahead: will your current selection fit your circumstances next year? Have you considered whether the changes announced in the Important Updates section will have an impact on your selections?

- Timing is everything: don’t leave it to the last few days to log in. Check your current selections now and leave plenty of time in case you change your mind.

- Partner Life Assurance: you must provide your partner’s details and complete their health declaration as part of the process, otherwise their cover will not be activated.

- Holidays: you need to re-select your days bought/sold. Remember, you can only buy/sell days during the annual window.

- Planning a change in working hours? Stop and think before you buy holidays you may not be able to use.

- Health Screening and Cycle to Work: remember you need to re-select these benefits each year.

- Pension contributions: are you on track for retirement or do you need to put away a little extra next year?

- Explore the pop-up links throughout the magazine for more information about the benefit or to see what extras you’re entitled to under certain benefits!

- Confirm Selections: make sure you get an email confirming your choices if you have made changes to your benefits. If you have not changed anything, your benefit statement for the next plan year will be available in your Total Reward Statement once the window has closed.

- Remember, there won’t be a mid-year window in 2024, so the benefits you choose this annual window are “locked” in for 12 months (Jan to Dec 2024).